BTC Price Prediction: Key Metrics Suggest Continued Bullish Potential Despite Short-Term Volatility

#BTC

- Technical Strength: BTC trades above key moving averages with Bollinger Bands suggesting trend continuation potential

- Institutional Adoption: Major financial players are increasing Bitcoin exposure through direct investments and infrastructure deals

- Regulatory Landscape: Failed legislation creates uncertainty but may delay restrictive policies that could dampen growth

BTC Price Prediction

BTC Technical Analysis: Bullish Indicators Emerge

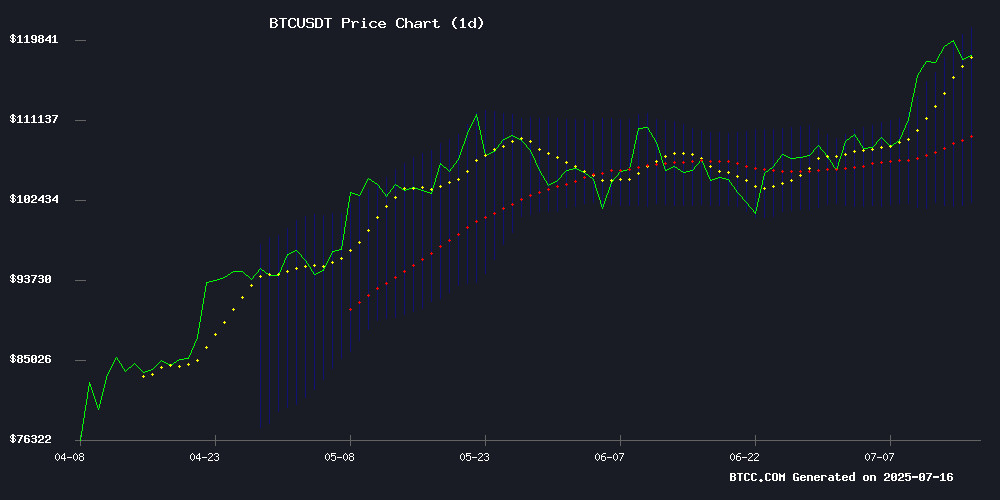

According to BTCC financial analyst James, Bitcoin (BTC) is currently trading at 117,387.55 USDT, above its 20-day moving average (MA) of 111,640.03, signaling potential bullish momentum. The MACD indicator shows a bearish crossover but with diminishing negative values, suggesting weakening downward pressure. Bollinger Bands indicate BTC is trading near the upper band (121,115.12), which could imply overbought conditions or continued upward movement if the trend sustains.

Mixed Market Sentiment as Bitcoin Faces Profit-Taking and Institutional Interest

BTCC financial analyst James notes that while bitcoin has seen profit-taking amid AI token rallies, institutional interest remains strong. Fidelity's increased stake in Metaplanet and Cantor Fitzgerald's potential $4B Bitcoin acquisition via SPAC highlight growing corporate adoption. However, failed crypto legislation and Robert Kiyosaki's pause on BTC purchases introduce short-term uncertainty.

Factors Influencing BTC’s Price

Robert Kiyosaki Pauses Bitcoin Purchases Amid Market Surge

Robert Kiyosaki, author of 'Rich Dad Poor Dad,' has temporarily halted his cryptocurrency acquisitions despite Bitcoin's record-breaking rally above $120,000. Known for his bullish stance on Bitcoin, gold, and silver, Kiyosaki's decision to pause further buys—except for one additional Bitcoin—signals caution amid uncertain economic conditions.

'Bitcoin at $120,000 is a double-edged sword,' Kiyosaki remarked on social media. 'While holders celebrate, greed could punish latecomers.' His strategy now hinges on waiting for clearer macroeconomic signals before committing more capital, even as speculation mounts over Bitcoin's potential to reach $200,000 or higher.

Economist Predicts Cryptocurrency Market to Skyrocket

Henrik Zeberg, a prominent economist, has released a bullish forecast for the cryptocurrency market, predicting a 250% surge in total capitalization to $12.95 trillion. The current valuation stands at $3.68 trillion, signaling a potential wave of renewed investor enthusiasm reminiscent of 2017 and 2021.

Technical indicators like the Relative Strength Index (RSI), Relative Vigor Index (RVGI), and Moving Average Convergence Divergence (MACD) all point to strong upward momentum. Zeberg highlights Bitcoin's position in the third wave of the Elliott Wave Theory, which typically brings rapid price appreciation before a significant correction.

Altcoins are expected to follow Bitcoin's lead, with the broader market poised for substantial growth. This projection comes as institutional interest in digital assets continues to climb, reinforcing cryptocurrencies' role in the future of finance.

Bitcoin Retreats Amid Profit-Taking as AI Tokens Gain on Google, Meta Momentum

Bitcoin slipped 1.8% to $117,800 as East Asian markets opened, with traders locking in gains after the cryptocurrency's relentless rally to successive record highs. While bullish calls for $160K-$200K targets persist, OKX's Lennex Lai warns of mounting risks as leveraged long positions and funding rates spike. "Euphoria-driven decisions could backfire," Lai cautioned, citing potential triggers from U.S. retail data and U.K. inflation figures due this week.

Meanwhile, AI-themed tokens outperformed as Big Tech's artificial intelligence developments buoyed sentiment. The divergence highlights crypto markets' bifurcated response to macro catalysts—with speculative altcoins riding the AI narrative while Bitcoin contends with overbought conditions. K33 Research's mid-year report echoes concerns about unsustainable leverage in BTC markets.

Fidelity Becomes Top Shareholder in Bitcoin-Focused Metaplanet

Fidelity Investments has significantly increased its stake in Metaplanet, a Japanese firm pivoting to Bitcoin-centric strategies. Through its subsidiary National Financial Services LLC (NFS), Fidelity now holds 84.4 million shares—a 12.9% stake valued at $816 million. This marks a dramatic surge from the 1.91 million shares held just three months prior.

The move underscores institutional momentum behind Bitcoin adoption. Fidelity, which manages a $25 billion spot Bitcoin ETF, joins Capital Group (6.6% stake) in backing Metaplanet’s treasury strategy. The firm currently holds 16,352 BTC ($1.9 billion) with $300 million in unrealized gains—a bold bet on Bitcoin as a corporate reserve asset.

Bitcoin Sees Groundbreaking Price Surge as Market Dynamics Evolve

Bitcoin surged to a record $123,000 in the United States, marking a 75% increase from November levels. Marion Laboure of Deutsche Bank noted this rally coincided with a historic drop in volatility, signaling a potential shift in Bitcoin's market behavior.

Regulatory developments appear to be driving both price appreciation and stability. Laboure observed: "We may be witnessing a gradual decoupling between Bitcoin's spot prices and its volatility." Institutional participation and regulatory clarity are contributing to this newfound stability in what was traditionally considered a volatile asset class.

Cantor Fitzgerald Nears $4B Bitcoin Acquisition via SPAC Deal with Blockstream's Adam Back

Cantor Fitzgerald is finalizing a landmark $4 billion bitcoin acquisition through its special-purpose acquisition vehicle, Cantor Equity Partners 1. The deal involves Blockstream CEO Adam Back transferring over 30,000 BTC—valued at more than $3 billion—to the SPAC in exchange for equity. Upon completion, the entity will rebrand as BSTR Holdings.

The SPAC, which raised $200 million in its IPO, plans to secure an additional $800 million from investors to expand its bitcoin holdings. Brandon Lutnick, appointed chairman earlier this year, is spearheading the transaction. This move signals Cantor Fitzgerald's aggressive push into institutional cryptocurrency exposure, bypassing traditional M&A channels.

Bitcoin Enters New Phase of Reduced Volatility, Says Deutsche Bank

Deutsche Bank analysts suggest Bitcoin is shedding its notorious volatility, entering a more stable phase of price action. The cryptocurrency recently hit a record high above $123,000—a 75% surge since mid-November—but the focus has shifted from price appreciation to its unusually calm market behavior.

"While excitement over upcoming legislation has spurred Bitcoin's sharp appreciation, it's notable that this rise has been accompanied by a historic decline in volatility levels," said Marion Laboure, Deutsche Bank analyst. This could signal a gradual decoupling between spot prices and volatility, where gains occur without wild price swings.

The shift coincides with U.S. lawmakers designating "Crypto Week" to discuss regulatory frameworks that may further legitimize digital assets. Bitcoin's maturation mirrors gold's historical trajectory, where early volatility eventually gave way to steadier store-of-value characteristics.

Key Crypto Legislation Fails House Vote Amid Republican Divisions

Major digital asset bills championed by former President Donald Trump collapsed in a U.S. House procedural vote during Congress's 'Crypto Week' initiative. The package—including the GENIUS Act for stablecoin regulation, CLARITY Act, and Anti-CBDC legislation—fell 196-223 as 13 Republicans broke ranks despite Trump's public endorsement.

Market reaction proved muted, with Bitcoin dipping 2.23% to $117,083. The failure leaves industry participants grasping for clarity as House leaders weigh whether to reintroduce modified versions. This legislative setback underscores the challenges of establishing coherent crypto frameworks even during dedicated policy pushes.

MARA Holdings Expands Bitcoin Strategy with $20M Investment in Two Prime

MARA Holdings has made a decisive move in institutional cryptocurrency strategy, committing $20 million to investment adviser Two Prime. The capital injection boosts the firm's Bitcoin holdings from 500 BTC to 2,000 BTC, marking a fourfold increase in exposure to the dominant cryptocurrency.

The assets will be actively managed through a Separately Managed Account, shifting from passive holding to yield generation. Two Prime's SEC-registered status provides institutional credibility as MARA seeks to offset mining revenue pressures following April's halving event.

Despite reporting $533 million in net losses last quarter, MARA continues doubling down on Bitcoin treasury strategies. The partnership reflects growing institutional preference for active crypto asset management over static reserves.

Bitcoin Rally Shows No Signs of Slowing as Key Metrics Remain Healthy

Bitcoin's surge past $120,000 has yet to show the classic signs of a market top, with on-chain data and liquidity metrics suggesting sustained bullish momentum. Swissblock's analysis highlights a disciplined market structure, contrasting sharply with the euphoric profit-taking typically seen at cycle peaks.

Glassnode's Short-Term Holder Relative Unrealized Profit metric—a reliable gauge of retail sentiment—remains well below January and April 2024 levels. This indicates investors aren't rushing to exit positions, a behavior that historically precedes major corrections. The absence of leverage-fueled speculation further supports the case for organic demand driving this rally.

Liquidity conditions mirror the 2021 bull market's healthier phases, with Woonomic's Speculation Index and VWAP Liquidity oscillators hovering in neutral territory. Such balance suggests capital is entering the market methodically rather than through the reckless speculation that marked previous tops.

Roxom to Launch First Bitcoin-Only Stock Exchange in September

Roxom plans to launch the world's first Bitcoin-based stock exchange in September 2025, offering spot and derivatives trading exclusively in BTC. The platform will enable users to trade assets like company shares and futures without fiat conversions, positioning Bitcoin as both a payment tool and a unit of account.

The exchange will feature Bitcoin Treasuries, a flagship product aggregating public companies with significant BTC holdings—such as MicroStrategy—onto a single BTC-native platform. "This is about architecting a Bitcoin-native financial future," said CEO Borja Martel Seward, emphasizing reduced reliance on traditional brokers and currency conversions.

Roxom aims to streamline exposure to Bitcoin-related investments by bypassing TradeFi barriers. The waitlist for early access is now open.

Is BTC a good investment?

Based on current technicals and market developments, Bitcoin presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +5.15% above | Bullish trend confirmation |

| Bollinger Position | Upper band proximity | Potential continuation or pullback |

| Institutional Activity | Fidelity, Cantor Fitzgerald deals | Strong long-term validation |

While MACD remains bearish, the narrowing histogram suggests momentum may be shifting. Consider dollar-cost averaging during periods of volatility.

Cryptocurrency investments carry high volatility risk. Past performance doesn't guarantee future results.